Edward Lambert On Bond Demand, The Coming Recession, And New Normal

Edward Lambert is the blogger at Effective Demand Research. He is a noted economist, having shared his work at Angry Bear Blog, where he is an active contributor, and elsewhere. He has come up with an equation to measure effective demand and predict recessions. His calculations indicate we are on the path to recession already. I will address that aspect of his work down the page, but what has excited me most about his theories is that he agrees with me about monetary theory.

He is the only economist I know of who has come right out and said that monetary theory is dead, a point which I have been trying to share with economists to no avail until I ran across his comments. Many economists simply refuse to speak about bond demand, like many Market Monetarists I have tried to engage. Dr. Lambert explained it to me this way in an email:

I agree with you. Money theory, as it applies to bonds, is dead. Basically

because the models of economists cannot grasp the new normal. That is where my

effective demand is making sense of so many things.

Krugman is waiting for the whites of inflation's eyes, but with after-tax

corporate profit rates at never before seen record highs, there is no price

pressure, too many firms are still able to undercut any price rise. So the

only thing that will bring on inflation is a substantial fall in after-tax

profit rates, which brings on a recession. So when Krugman gets his inflation,

a recession will already be happening. [Emphasis Mine]

Dr Lambert read some of my articles on Talkmarkets regarding these subjects, and the email he sent spoke to Effective Demand and to fiscal stimulus as an economic tool:

Economic theories have not grasped how the economy has changed. For me,

getting a working model for effective demand has made the difference. My

models are describing cycles that existing models cannot do...

About fiscal stimulus, I do not think it will work. Any money injected into

the circular flow of the economy will just flow into high corporate profit

rates and low labor share. Effective demand will stay weak. And with

unemployment low, and some marginal firms unable to pay the rising wages,

there will be internal decay in the business cycle leading to a contraction.

The contraction will want to clean out marginally unproductive firms. It is

long overdue with these low interest rates that we have had for years.

The pressure will build for wage increases. So the pressure on marginal firms

will build too. That cascades into a contraction.

More economists are expecting a recession in a few years, like Larry Summers.

But a recession is closer than they think because they still have one foot in

the camp that thinks there is still lots of slack. Yet as Keynes described it,

weak effective demand will keep the economy from reaching normal full

employment. The slack we see now will not be used due to weak effective

demand. So the recession will come on earlier than they think. [Emphasis mine]

For more on the concept of Effective Demand, Dr Lambert has put together a Synopsis of Effective Demand on his blog. The effective demand limit has an equation that he created that can tell us that:

In 2015, capacity utilization fell while the utilization of labor increased (unemployment fell). The equation predicted this.

Dr Lambert's conclusion is that:

Unlike capital, labor never reaches its optimum utilization since it never reaches zero in the graph. Capital comes first in capitalism. And since the 1990's, the utilization of labor has been getting worse as seen by the plot steadily trending upward. The increasingly unmet potential of labor utilization coupled with lower labor share is a problem. The US is becoming over-capitalized in relation to the labor force. Supply-side economics can be partly blamed for this?

The chart he refers to is at the Synopsis. Dr Lambert went on to say in separate emails:

When labor share declines, so does the optimization level of capacity utilization.

In other words, profit rates increase, but the maximum utilization level of capital declines. As such potential GDP declines too.

and:

When the decline in production due to lowered optimization of capital is not factored in, one cannot see that potential GDP has declined. My model saw that potential GDP declined in real time as the crisis appeared. The CBO and Fed have been very slow in realizing this. They still haven't.

In essence, they missed the biz cycle. Real GDP has already gone positive and is now falling relative to potential.

and the definition of effective demand limit, a new economic concept:

It is a limit placed on the utilization of labor and capital by the percentage of labor share of income. It has always been there in every business cycle. It determines such things as potential GDP and the profit rate cycle. [Emphasis mine]

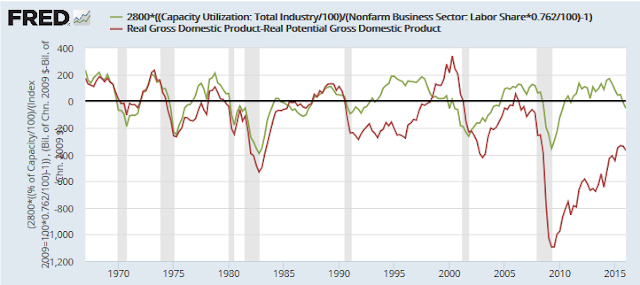

I believe that Dr Lambert is essentially saying that labor's share of income is low, and GDP simply will not grow and that it may take a recession to fix the problems and we are headed there. Dr Lambert likes the Scott Sumner idea of NGDP Targeting but the key of any stimulus is to increase potential GDP. Also at his synopsis page he offers this FRED chart:

So basically, the chart shows two things. The red is the traditional CBO measure of the output gap, which is real GDP minus potential GDP. The green is Edward Lambert's measurement of the effective demand limit caused by labor's share of income being low. He is saying the growth cycle has already passed and the green line indicates the road to recession. He says the Fed missed the interest rate cycle already!

Dr Lambert encourages those of us who are not economists to actively attempt to understand how the economy works. Probably his work at Atlantic International University as a tutor has given him the patience to attempt to convey important economic concepts to non economists. The lack of understanding of the New Normal by economists and non economists alike is limiting the advancement of the discipline. Economists are often too remote to bother with non economists. And they are often stuck in their schools and cannot see other and more contemporary concepts.

We can only observe the outworking of his efforts, to see if he has a better measurement of the growth cycle going forward. He sees no problem with derivatives as they exist and believes that massive bond demand will not get in the way of efforts to raise rates when needed in a modest but way. That timeliness has not been utilized. He does not think rates need to plunge into the negative, but will have be range bound due to demand for bonds.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

The comment was deleted!

I think you are right. Many people, George, seem to be interested in the next big innovation that would pull us out of our malaise, but if anything, some of our innovations will doom labor. We need innovations that do not doom the labor force.