Dr. Lambert's Effective Demand Recession Indicator

There is a simple explanation of Edward Lambert's concept of Effective Demand. It is provided by Angry Bear blogger Steve Roth. This is just an explanation that we all can understand. Applying this guide to the real economy may change your thinking, and certainly will add an economic indicator to your arsenal.

Here are 5 points of the model:

1. Real GDP: During the business cycle, when real GDP goes up, so does Effective Demand.

2. Labor Share: When labor share rises, effective demand increases due to more relative power for household consumption demand.

3. Capacity Utilization: When capacity is heavily utilized, then it costs more to produce goods.

4. Unemployment Rate: When unemployment declines, effective demand declines. At the full employment limit, it is difficult for the economy to produce more. Full unemployment constrains future growth.

5. Effective Demand Limit: Real GDP increases as more capacity and labor is utilized. However, there is a limit set by the relative power of labor's share of income to purchase goods. This is not an issue during the business cycle but becomes a problem at the end of the business cycle.

Edward Lambert expands on number 5:

In a business cycle, real GDP rises as more labor and capital are utilized. When real GDP reaches the level of effective demand (potential demand), a recession would ensue. The economy will go through various changes between the time real GDP reaches effective demand and the start of the recession.

So, when real GDP exceeds effective demand the economy slows. Roth says:

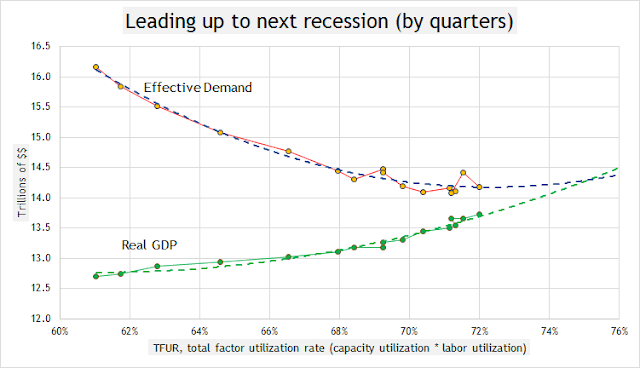

As you can see, the ends of business cycles (beginnings of recessions), are characterized in this model by a stylized fact: real GDP approaching or exceeding this measure of effective demand. Capacity utilization increases quite smoothly up to that point (the “good” part of the business cycle), then declines (often after a chaotic period that can last quite a while; see 1995-2000).

While Roth lists the recessions past with maps that you should look at which Dr. Lambert supplied him, the current one shows we are on track for another recession as effective demand is likely tracking to cross real GDP soon. While Dr. Lambert recalculates the data often, we can see by the chart that effective demand can be rising, but not as fast as real GDP, resulting in an eventual crossing of the streams. We all know that bad things happen when the streams are crossed, and the same holds true for this economic indicator:

|

Effective Demand and Real GDP Soon to Cross Paths? by permission |

Edward Lambert has said that the US has become overcapitalized compared to the utilization of the labor force. This is certainly something along the lines of a possible trap Donald Trump could fall into, seeking to continue the policies of supply side economics which comes across as Trickle Down but is really a limited Trickle Up idea, benefiting a few at the top. Dr. Lambert has said Supply Side Economics contributes greatly to labor losing ground.

An example of effective demand in action is what happens when people are constrained by various issues in society. Issues in one market may spill over into lessening demand in another market as we see from Wikipedia:

Disequilibrium in one market can affect demand or supply in other markets. Specifically, if an economic agent is constrained in one market, his supply or demand in another market may be changed from its unconstrained form, termed the notional demand, into a modified form known as effective demand. If this occurs systematically for a large number of market participants, market outcomes in the latter market for prices and quantities transacted (themselves either equilibrium or disequilibrium outcomes) will be affected.

Examples include:

- If the supply of mortgage credit to potential home buyers is rationed, this will decrease the demand for newly built houses.

- If laborers cannot supply all the labor they wish to, they will have constrained income and their demand in the goods market will be lower.

- If employers cannot hire all the labor they wish to, they cannot produce as much output as they wish to, and supply in the market for their good will be diminished.

Markets and businesses can be constrained by fear, or firms could be credit constrained, or companies cannot find the people they need or cannot pay the wage necessary to hire the people they need. Likewise, consumers could be constrained, by high gas prices, by higher taxes, by the inability to borrow because of a credit freeze or simply credit rationing hurting customers' borrowing for what they really want to buy:

If there is credit rationing, some individuals are constrained in the amount of funds they can borrow to finance goods purchases (including consumer durables and houses), so their effective demand for goods, as a function of this constraint, is less than their notional demand for goods (the amount they would buy if they could borrow all they want to).

Lambert measures the effective demand limit as conditions continually change by use of the equation he developed, and it shows when economies are close to getting in trouble. If capital wins big and labor is shut out of purchasing that which is produced, the effective demand limit can throw nations into recession as the end of the business cycle shows a lack of reward for the people who made the products. They do not get their fair share, and potential demand is not realized.

There is much more that serious students of economics will find useful as they continue to study Dr. Lambert's effective demand breakthroughs. Predicting recessions can be a complex endeavor and having all the tools means including these, as Dr. Lambert has a successful track record in using his calculations.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

Good article.

Thanks for sharing

Kudos on a really great article, Gary. (Even if the title does sound like a men's hair tonic lol).

Your take on the title, Wendell, is very astute and very funny. In the second to last paragraph I meant to say notational demand rather than potential demand as notational demand would reflect what people could buy (and borrow) if they were more able to do so. There is a lot of demand just not being met due to the reality of effective demand limit.