Broad Market Not Participating

The Short-Term Trend

The short-term trend is down as of Friday. The Junk Bond chart shows the break in trend clearly.

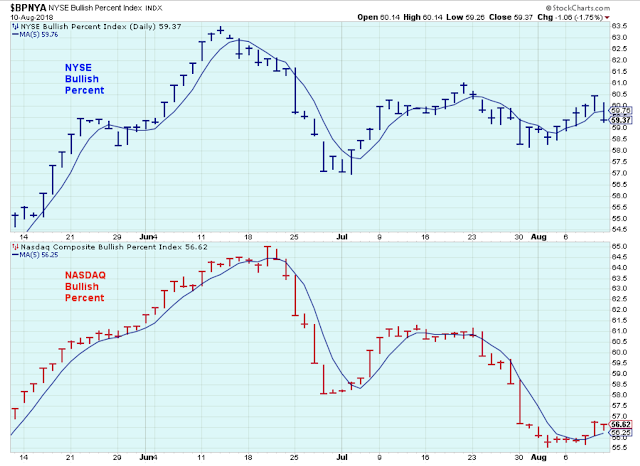

This chart below shows how the NYSE stocks remained reasonably healthy over the last few months while the NASDAQ stocks were weakening. Then again, with the SPX pushing to new highs, this chart of the bullish percents shows that the broad market is not participating.

One bad day in the market doesn't mean much, but I have been feeling negative towards stocks for a while because the indexes were climbing while the number of participating stocks were declining.

We have all seen this before, and sometimes the strong stocks eventually lead the weaker stocks higher.

But so far there is little to indicate that the weaker stocks want to participate, and, in my view, that means that this rally will run out of steam.

In the short-term, I do not like stocks.

The Long-Term Outlook

US stocks are shown in the top panel, and German stocks in the lower panel. These two markets are usually highly correlated, but lately they are parting ways. US stocks are pointed higher while German stocks are pointed sideways. I don't like it.

The Semiconductors are critical.

The ECRI index is too weak. It is pointing to a slowdown in the economy, and this does not favor higher prices over the remainder of the year.

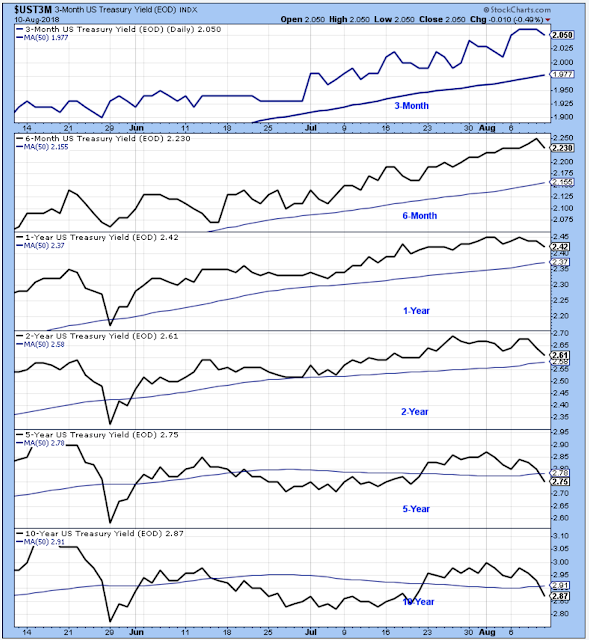

Rates

Short-term yields are still pointed higher, but longer-term yields are once again pointing lower.

Outlook Summary:

The long-term outlook is cautious. The ECRI index points to an economic slowdown.

The medium-term trend is up as of May-10. Sentiment indicates caution.

The short-term trend is down as of Aug-11.

The medium-term trend for bond prices is up as of Aug-11 (prices higher, yields lower).

Investing Themes:

Technology

Medical Products

Cyber Security

Payment Processors

Small and Micro Caps

Gaming

Strategy:

- Buy large cap stocks and ETFs at the lows of the medium or short-term trends.

- Buy small cap growth stocks on breaks to new highs in the early stages of short-term up trends.

- Stop buying when the short-term trend is at the top of the range.

- Take partial profits when the uptrend starts to struggle at the highs.

- Never invest based on personal politics.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

The broad market hasn't been performing that well for some time. It's a result of the zombie economy. The reason why the stock market has been doing well is that larger companies are able to grow by consuming the market of the rest of the economy and this shows in the stock market as well. The more massive banks have consumed the smaller banks and financials. The more massive tech companies have grown so big that buying up even mid sized companies doesn't affect them in the slightest. And the small mom and pop businesses are dying up by the boatload.

This can still go on for years, but it makes the US economy more and more fragile because the author is right. This can not go on forever. Cannibalization isn't ever a long term solution for anything.