Anatomy Of A Great Trade

So, I’m sitting here agonizing over whether I should sell short the U.S. Treasury bond market (TLT) once again.

Thanks to the bombshell Israel announced alleging the existence of a secret Iranian nuclear missile program, oil has rallied by 2%, the U.S. dollar has soared, and stocks have been crushed.

The TLT has popped smartly, some $2.5 points off of last week’s low, taking yields down from a four-year high at 3.03% down to 2.93%.

The report is probably based on false intelligence, which is becoming a regular thing in the Middle East. Suffice it to say that the presenter, Prime Minster Benjamin “Bibi” Netanyahu, may soon be indicted on corruption charges. Clearly, they are going “American” in the Holy Land.

But for today, the market believes it.

You can understand me chomping at the bit, as selling short U.S. government bonds has been my new rich uncle since the market last peaked in July 2017. 35% of my profits over the past year came from selling short Treasuries. You should do the same.

Falling Treasury prices have been one of the few sustainable trends in financial markets during the past year.

Stock rallied, then gave up a chunk. Gold has gone nowhere. Only oil has surpassed as a sustainable trade, thanks to successful OPEC production quotas, which have been extended multiple times. Texas tea is up an admirable 67% since the June $42 low. And who was loading up on crude way down there? Absolutely no one.

Of course, I have an unfair advantage as a bond trader, as I have been doing this for nearly 50 years. I caught the big inflation driven fixed income collapse during the 1970s, which had a major assist then from a rapidly devaluing U.S. dollar.

That’s when they brought out zero-coupon bonds, effectively increasing our leverage by 500% for virtually no cost. Principal-only strips followed, another license to bring money on the short side.

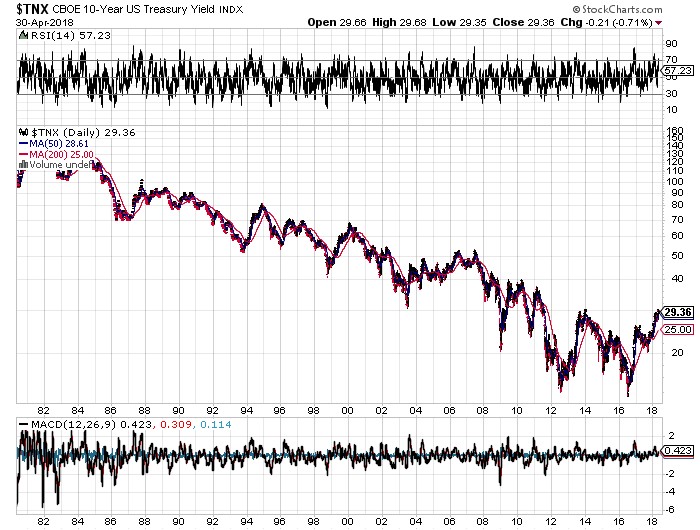

The big lesson from trading this market for a half century is that trends last for a really long time. The bull market in bonds that started in 1982, when 10-year yields hit 14%, lasted for 33 years.

As we are less than three years into the current bear market the opportunities are rife. We are very early into the new game. This one could last for the rest of my life.

The reasons are quite simple. The fundamentals demand it.

1) The Global Synchronized Recovery is accelerating.

2) The Fed will start dropping on the bond market in the very near future $6 billion a month, or $200 million a day, worth of paper in its QE unwind.

3) Tax cuts will provide further stimulus for the U.S. economy.

4) With the foreign exchange markets now laser-focused on America’s exploding deficits, a weak U.S. dollar has triggered a capital flight out of the U.S.

5) We also now have evidence that China has started to dump its massive $1 trillion in U.S. Treasury bond holdings.

All are HUGELY bond negative.

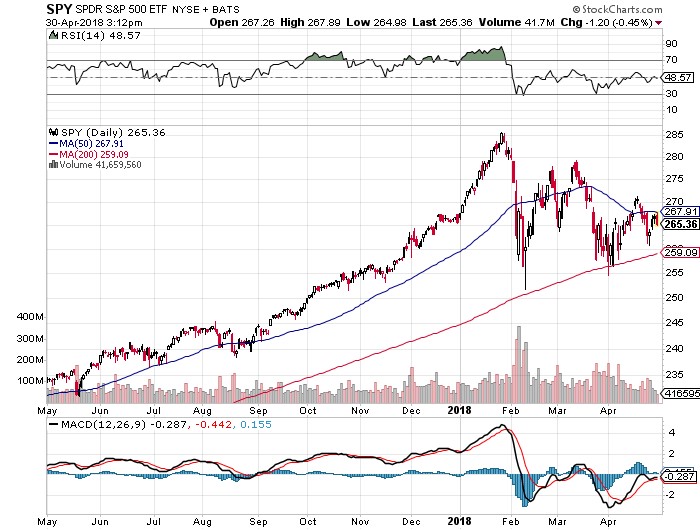

All of this should take bonds down to new 2018 lows. What we could be seeing here is the setting up for the perfect head and shoulders top of the TLT for 2018.

As for that next Trade Alert, I think I’ll hold out for a better price to sell again. What’s the point in spoiling a perforce record?

The Diary of a Mad Hedge Fund Trader, published since 2008, has become the top performing trade mentoring and research service in the industry, averaging a 34.84% annual return for ...

more