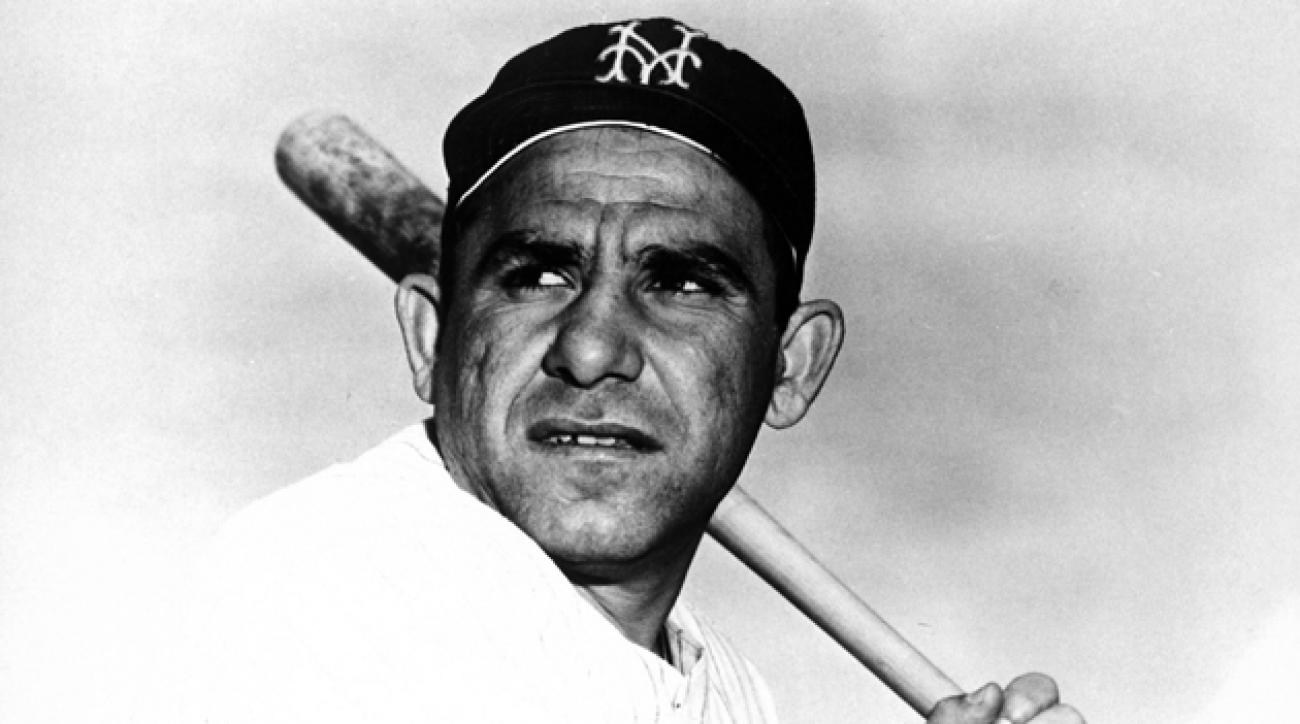

A Yogi Berra Stock Market

Let’s start with some housekeeping issues, since I left Barron’s a few weeks ago I wanted to take a break from writing about the markets. But since you found me here on an off-Broadway website (don’t tell the owners) you know it is hard to let go. Therefore, I’ll probably jot down a few thoughts from time to time in various locations and unlike my time at major investing websites, I’ll welcome the comments. Unfortunately, 90% of the comments there sought to educate me about how stupid I am and the 10% that had legitimate questions and thoughts were lost in the shuffle.

If you’ve been following me at the (free) weekly Midday Market Call webinar with Ally Invest, you know that I’ve been talking about preparing for a correction for several weeks. The bottom line was “stay long but prune the underperforming stocks and build up a little cash.” Not bad for this market and for every other market that seems to be a bit out of hand or extended.

Now that the Dow is down more than 1000 points in just a few sessions – and that does not include Monday’s whoosh opening with a 350-point BTFD* dip – we now have to ask whether it’s over or not.

That great stock market analyst Yogi Berra has an answer for both bulls and bears. It ain’t over.

It ain’t over for the correction or for the bull market?

The answer is yes. Both of them ain’t over.

Now that I’ve washed my word processor out with soap for writing that word three times, let’s look a bit deeper into what is going on.

First, the big picture – the bull market. I think there is plenty of life left in this market because nothing really changed technically over the past two weeks. Sure, it was a big decline and the so-called fear index – the VIX – jumped to a level not seen since the election. Remember how fearful half the country was back then?

Remember, also, that it marked the start of a rootin’ tootin’ rally.

Do you know what trader extraordinaire Larry Williams (yeah, Michelle’s dad) calls the VIX? One over the S&P 500. It is just the inverse of the market.

Anyway, the S&P 500 is now below its short-term averages. I look at the 10-day simple, 20-day expo and 30-day expo because that’s what my trading friend Dave Landry uses in his moving average crossover system for short-term trading (see Chart 1). He calls it a bowtie because that’s what it looks like when they cross.

The index closed below all three averages on Friday. But it did that in November, too, and that was just a little speed bump. Granted, this month’s speed bump is a big one but we can look back to several dips last year with the same characteristics. What did not happen most of that time was a crossover of the averages.

And no sooner do I write this than I show you August’s decline and crossover, which ended up being a whipsaw. The point I am trying to make is that just dips below the averages are not that big of a deal. Crossovers are, although they are subject to false signals.

If this stuff were perfect I would not be at my desk right now telling you about it. It does work more often than it doesn’t so use it as part of your trading plan. Use other things, too.

What other things? How about longer averages? Once the current leg of the greater bull market got going in early 2016, the index did not dip below the 200-day average with only one exception – Brexit in June 2016. That weakness last two days.

Therefore, the short-term breakdown needs to be a bit more robust in a bull market. Short-term buy signals can be weaker, as long as the major trend is intact.

With all the fear out there, please remember the market is still six days removed from all-time highs, it trading where it was just 16 trading days ago, is still up for the year and most importantly is still holding its 50-day average.

And for all the selling and new 52-week lows, the NYSE is still in a big bullish trend. This month’s dip is no worse than any other dips we’ve seen February 2016 (see Chart 2).

Yes, it can always deteriorate more but we chartists cannot deal with hope and conjecture. So far, the charts just show a pullback in a very overbought market.

In the National Football League, a team that starts undefeated in the season and wraps up a playoff berth early has a big decision to make. Does it go for the perfect season and finally shut up the 1972 Miami Dolphins or rest its starters to win the real prize – the championship?

For the stock market, it was a hot, hot season that claimed record after record for consecutive up-months, most all-time highs and longest streak without a decent correction. Right now, consider the pullback that first loss that removes the possibility of getting that perfect season but at the same time does not kill the players. Now they can take a rest, recharge their batteries, look at fresh strategies away from the euphoria of a runaway market to cloud their judgment.

In other words, it’s now OK not to be fully invested for a change. FOMO is dead – finally. Maybe we’ll see a more sustainable trend develop.

That’s my case for more gains later in the year. However, the question still remains about the current swoon’s lifespan. It roared back from down 350 Monday morning but then the whoosh was followed with a flush. Down 430 as I put this story to bed.

I won’t make a call on how low it will go but I will say that the 50-day average is a pretty good place to look for a tradable bottom to form. Or, it could be the trendline from last August (see Chart 3). Note I did not say it is an exact price target. Just somewhere in the vicinity is a good place to start looking.

Why two targets? Because I am not forecasting a time for the correction to end. Both of these features will rise to meet current prices within the next few weeks. And that means downside risk for picking up your favorite – and yes, fundamentally sound – stocks is small right now.

How about Apple? It’s already ticked the “correction” box with a 10% decline from its peak early Monday (see Chart 3). And it landed at support and its 200-day average with what could be a bullish one-day reversal bar Monday (I’m writing before lunch).

Don’t like Apple? Too nervous to BTFD?

Go make a list of your favorite stocks and write down prices that represent 10% declines. How about Nvidia (NVDA)? It was down 10% now while 12% down puts it on strong support and its own 200-day.

I’m not so sure how interest rates play into this, hence my lack of time component. The fear is for more Fed rate hikes than Grandmaster Y mentioned. But the reason is that the economy is cooking with gas and that is a good thing for stocks.

Let me know what you think but try to keep it mostly on the technical analysis side.

*BTFD – buy the f***ing dip

Disclosure: No positions in anything covered.

Good read.

Will you be posting your midday market calls here as well?

No, I will not post them here. However, you can always view the stock i cover at my website http://quicktakespro.com/COTD.html. Ally does some sort of archiving.

Thanks, I'll keep that in mind though I do try to get all my content from as few sites as people. This being one of my favorites.

August saw a significant pullback that caused the moving average cross/ whipsaw. It also created an anchor point for the trendline mentioned.

You mentioned August twice - would you mind clarifying the relevance? Thanks.